The aerospace and defense Outlook (A&D) sector is one of the most important and significant areas of the world economy. With the help of expanding defense funds, changing market demands, and technology breakthroughs, innovation flourishes there.

With its noteworthy contributions to innovation, safety, and security, the sector is well-positioned for future expansion.

For both commercial and military uses, A&D is essential to improving the performance and safety of airplanes and spacecraft.

The emphasis is on pushing the limits of technology to satisfy the demands of a constantly evolving society, from sophisticated defense and control systems to powerful weapons.

In addition to its economic importance, the A&D sector supports many other industries, fosters innovation, and generates employment.

It affects everything from the safety of daily travel to cutting-edge technologies, making it a pillar of global security and advancement.

According to the Business Research Company report, In recent years, the size of the aerospace and defense market has increased significantly. Growing at a compound annual growth rate (CAGR) of 5.8%, it will reach $1098.86 billion in 2029 from $875.37 billion in 2025.

In 2024, the aerospace and defense market was dominated by North America. Throughout the projected period, North America is anticipated to increase at the fastest rate.

The aerospace and defense market study covers the following regions: North America, South America, the Middle East, Africa, Asia-Pacific, Western Europe, and Eastern Europe.

The expansion of emerging markets, rising air travel demand, rising military spending, growing use of military drones, and the development of autonomous fighter jets are all factors contributing to the historic period’s growth.

Aerospace Industry

Researching, designing, building, operating, and maintaining airplanes and related systems is the focus of the aerospace industry, sometimes referred to as the aviation sector.

It covers a broad spectrum of aviation-related goods and services, including engines, avionics systems, drones, helicopters, and both military and commercial aircraft.

Among the biggest and most influential businesses in the US, the aerospace sector serves the following five markets: general aviation, commercial airliners, space, military aircraft, and missiles.

As mentioned in the Investopedia report, The world’s largest aerospace industry, the United States, supplies the rest of the world with the majority of its military and commercial aerospace equipment.

Approximately 25% of aerospace workers are engineers, scientists, and technicians due to the industry’s strong emphasis on research and development (R&D).

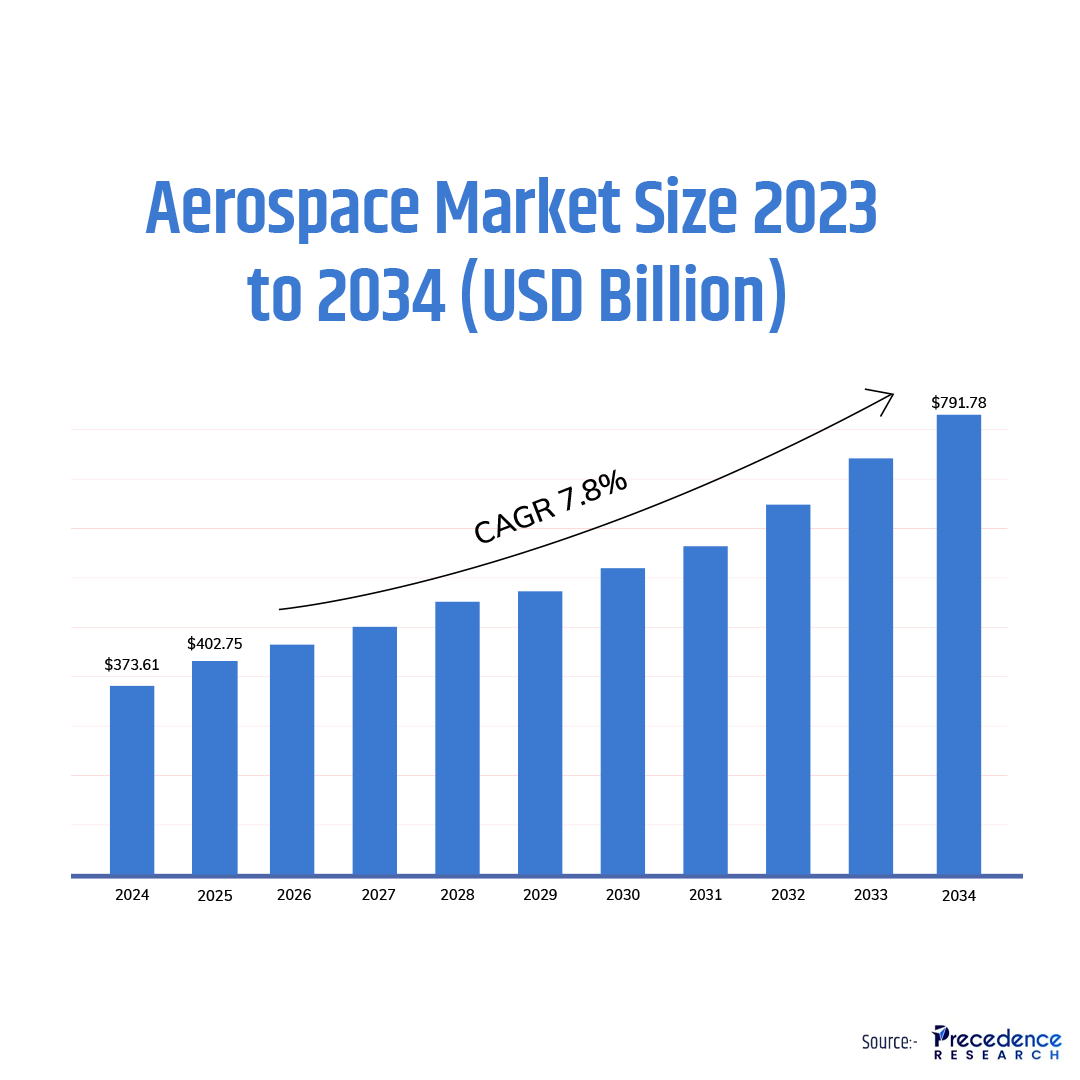

According to the Precedence Research report, The size of the worldwide aerospace market was USD 373.61 billion in 2024, increased to USD 402.75 billion in 2025, and is expected to reach approximately USD 791.78 billion by 2034, indicating a robust compound annual growth rate (CAGR) of 7.8% from 2024 to 2034.

The size of the North American aerospace market is projected to reach USD 171.86 billion in 2024 and is anticipated to expand at the quickest compound annual growth rate (CAGR) of 7.91% during that year.

The size of the North American aerospace market is projected to reach USD 171.86 billion in 2024 and is anticipated to expand at the quickest compound annual growth rate (CAGR) of 7.91% during that year.

The growing demand for air travel and air traffic are the main drivers of the aerospace sector. A vast range of aircraft and spacecraft, including helicopters, gliders, military and commercial aircraft, satellites, launch vehicles, and other associated goods, are manufactured by the aerospace sector.

According to the mmindia research, the Indian aerospace and defense (A&D) market is projected to grow to a value of approximately $70 billion by 2030. This growth is anticipated to continue as a result of government initiatives and improved infrastructure.

Over the last five years, India’s airline industry and passenger traffic have grown at a rate of more than 15 percent annually. In the last ten years, the country’s domestic and international air travel passenger count has grown from about 70 to 200 million.

Trends in the Aerospace Industry in 2025

Artificial Intelligence

One of the most notable developments in aerospace is the expanding application of artificial intelligence in both defense and aerospace.

Automating manual procedures and removing human error is the main goal of AI adoption in the aerospace industry.

Among other AI-related technologies, computer vision, machine learning, and artificial intelligence (AI) uncover new relationships and patterns in the data to offer insights.

The technology enables aerospace companies to optimize customer service and system administration, enhance safety, and change their manufacturing processes.

Furthermore, AI removes human mistakes, promotes efficient decision-making, and can solve complicated issues faster than humans. Artificial intelligence is used in the aircraft industry for manufacturing, pilot training, air traffic control, and fuel efficiency.

According to the market.us report, The size of the global aerospace artificial intelligence market is anticipated to reach around USD 34.2 billion by 2033, up from USD 1.2 billion in 2023, with a compound annual growth rate (CAGR) of 39.8% from 2024 to 2033.

Artificial intelligence (AI) is being used more and more in the aerospace sector to improve a range of processes, from aircraft manufacturing to flight operations and maintenance.

Aerospace operations are made more cost-effective, safe, and efficient with the usage of AI technologies. These applications include flight optimization, which enables more fuel-efficient routes and operations, and predictive maintenance, which helps foresee mechanical issues before they happen.

Digitization

The aerospace sector uses smart factories and digital technology to guarantee effective manufacturing and quicker design to delivery. Additionally, process digitization helps aerospace businesses maintain their agility.

In addition to facilitating effective supply chain management, digitization improves the operating systems of spaceships and airplanes. For example, digitization enhances communication amongst all stakeholders and removes data silos between internal systems.

The data also facilitates data-intensive solutions like digital thread, digital twins, and sophisticated analytics, and it streamlines engineering processes. Aerospace manufacturers and aviation providers can avoid bottlenecks and increase productivity as a result.

Additive Manufacturing or 3D Printing

The process of turning digital 3D or CAD representations into three-dimensional objects, known as additive manufacturing (AM) or 3D printing, involves layering materials until the desired object is ready.

The aerospace industry benefits primarily from additive manufacturing’s ability to increase manufacturing efficiency (through quick prototype development) and provide lighter parts for satellites, spacecraft, and airplanes.

Advanced Satellite Technology

Satellite applications are accelerating and are predicted to increase in 2025 and beyond. The bulk of commercial space operations are satellite launches, and this trend is predicted to continue in the foreseeable future.

The main forces behind this are the declining costs of satellite launches and the increasing demand for satellite imagery and geospatial intelligence.

The rising demand for satellite imagery and geospatial intelligence, as well as the declining cost of satellite launches, account for this.

Additionally, the necessity for worldwide connectivity and the widespread usage of the Internet of Things encourages the rapid advancement of satellite technology.

Satellite-based communication systems are also driven by the requirement for worldwide connectivity for the integration of the Internet of Things (IoT). Additionally, satellites are optimized by additive fabrication.

Blockchain

Achieving resilience in complex supply chains is one of the main trends and continuous difficulties in the aerospace and defense industries.

It is essential for allowing manufacturers’ competitiveness and reducing their risks and financial losses. This is where blockchain may help: it provides high-level data security and network resilience while facilitating transparent information sharing.

As a result, aerospace companies can improve supply chain visibility, reduce associated risks, and boost supply chain effectiveness. Because the aerospace sector depends on intricate supply chains, blockchain enhances supply chain data visibility and accessibility.

The worldwide aviation blockchain market was estimated to be worth USD 687.5 million in 2023 and is expected to rise at a compound annual growth rate (CAGR) of 18.9% from USD 831.1 million in 2024 to USD 3,315.6 million by 2032, according to the Fortune Business Insights research. With a 34.62% market share in 2023, North America led the aviation blockchain industry.

Aerial Mobility

A novel approach to urban mobility, advanced air mobility, also known as aerial mobility, makes use of cargo drones and flying cars with electric vertical takeoff and landing (eVTOL).

The aerospace industry has been rapidly developing this relatively new technology in recent years.

Advanced air taxis and drones for emergency services and hyperlocal deliveries are examples of advancements in aerial mobility.

Faster flight technologies, such as supersonic and hypersonic flights, are also seeing an increasing revival to cut down on passengers’ air travel time.

Immersive Technology

Immersion technologies, such as virtual and augmented reality, enable the visualization of digital data superimposed over real-world objects.

Immersion technologies are used for employee training in the aerospace industry and for aerial military operations. Among many other operations, they facilitate the viewing of navigation systems, air traffic control, and weather airspace data.

Facilitating Decarbonization

One of the most difficult trends facing the aerospace industry is this one. Decarbonization is a trend that will continue for at least a few decades after the implementation of numerous efforts meant to lessen the detrimental impact of carbon emissions on climate change.

To solve the sustainability dilemma, they are anticipated to concentrate on operational and technological advancements as well as take advantage of recent advancements in aircraft engineering and innovative technologies.

Sustainability

The aerospace industry is being forced to lower its carbon footprint because of growing traveler concerns about climate change.

Innovations in technology help them reach this objective and make the shift to sustainable operations. To reduce carbon emissions, for instance, biofuels lessen the reliance of aerospace operations on fossil fuels.

Likewise, additional alternative energy sources, such as electric aircraft technology, let the business reduce emissions even more.

Energy-efficient integrations and innovative designs also contribute to increased fuel economy, which lowers emissions and fuel expenses.

According to the Markets and Markets report, The market for sustainable aviation fuel was predicted to be worth USD 1.1 billion in 2023 and is projected to increase at a compound annual growth rate (CAGR) of 47.7% to reach USD 16.8 billion by 2030. Several important elements are driving the sustainable aviation fuel industry’s strong growth.

Internet of Things

There are several opportunities when IoT technology is integrated into the aviation sector. In addition to increasing operational effectiveness, it transforms the traveler experience.

However, IoT deployment has its share of advantages and difficulties, just like any revolutionary invention. Predictive maintenance is made easier by real-time aircraft component monitoring made possible by IoT integration in aviation.

Airlines can minimize downtime, lower maintenance costs, and improve fleet reliability by proactively recognizing possible problems and taking prompt action.

According to the precedence research report, The size of the global IoT market for aerospace and defense was USD 63.76 billion in 2024, increased to USD 75.87 billion in 2025, and is expected to reach approximately USD 363.09 billion by 2034, indicating a robust compound annual growth rate (CAGR) of 19% from 2024 to 2034.

The North American IoT market for aerospace and military is projected to reach USD 27.42 billion in 2024 and expand at the fastest compound annual growth rate (CAGR) of 19.12% during that time.

Defense Industry

Defense encompasses a variety of operations, such as the manufacture of military equipment for the air, sea, and land, as well as support and auxiliary equipment like radar, satellites, sonars, and other auxiliary equipment, as well as the upkeep, repair, and reconstruction of defense equipment.

Auxiliary equipment, defense support, maintenance, repair, and overhaul services, air-based defense equipment, sea-based defense equipment, and land-based defense equipment are the primary categories of defense equipment.

According to the Itonics assessment, major technical developments will force a dramatic transition in the defense industry during the next two to ten years. AI, autonomous systems, and cybersecurity advancements will improve military operations, logistics, and threat identification shortly (two to four years).

As technologies drive changes in military operations and plans, 2025 is a pivotal year for the defense sector.

The size of the military market has increased significantly in recent years, per a report by the Business Research Company. At a cumulative annual growth rate (CAGR) of 6.4%, it will increase from $491.06 billion in 2024 to $527.06 billion in 2025 and then to $676.64 billion in 2029.

The historical period’s increase can be ascribed to many factors, including the growing use of military drones, the need for attack and transport helicopters, low interest rates, rising military equipment spending, the development of autonomous fighter jets, and rising military spending.

The historical period’s increase can be ascribed to many factors, including the growing use of military drones, the need for attack and transport helicopters, low interest rates, rising military equipment spending, the development of autonomous fighter jets, and rising military spending.

Unmanned combat vehicle adoption, creative new military avionics upgrade programs, augmented and virtual reality, edge computing in defense, 3D printing, strategic mergers and acquisitions, the use of artificial intelligence (AI) in defense equipment (such as drones and helicopters), design upgrades and modularity for military-style weapons, and day/night technology for light weapons are some of the major trends for the forecast period.

Trends of the Defense Industry in 2025

Artificial Intelligence

It is impossible to have a conversation about breakthrough technology in military defense without including talking about the use of artificial intelligence.

The development of military AI enhances situational awareness, prognostication, and particular decision assistance. AI would be used by autonomous military devices to carry out tasks like monitoring and “real-time threat detection.” AI is utilized in the defense industry for cybersecurity, sophisticated weapon development, military training, and monitoring.

Additive Manufacturing

The defense industry is changing as a result of additive manufacturing, which makes it possible to produce vital components quickly and affordably.

As demonstrated by the Air Force’s use of 3D printing for faster and less expensive part fabrication, it enables the replacement of outdated automobile and airplane parts.

Additionally, by simplifying design and lowering labor costs, the technology helps build a variety of structures like bridges and shelters.

It also contributes to lowering the weight and expense of defense equipment by creating lightweight, material-efficient components.

The military can solve supply chain issues with on-site 3D printing, guaranteeing operational flexibility and innovation in 2025 and beyond.

Advanced Defense Equipment

Technologies like space militarization, directed energy, and hypersonic weaponry are improving the defense industry.

Greener alternatives to conventional fuels and electric power are becoming more and more popular in response to the drive for net-zero emissions.

Furthermore, advances in nanotechnology and biotechnology are making it possible to create self-healing armor, which will improve military protection.

Internet of Military Things

The other revolutionary development in military operations is the Internet of Military Things. More automation, better decision-making, and safe real-time data exchange are all made possible by this network of devices, technology, and the Internet. To share and analyze current data, which is crucial for current methods, IoT makes use of connective gadgets.

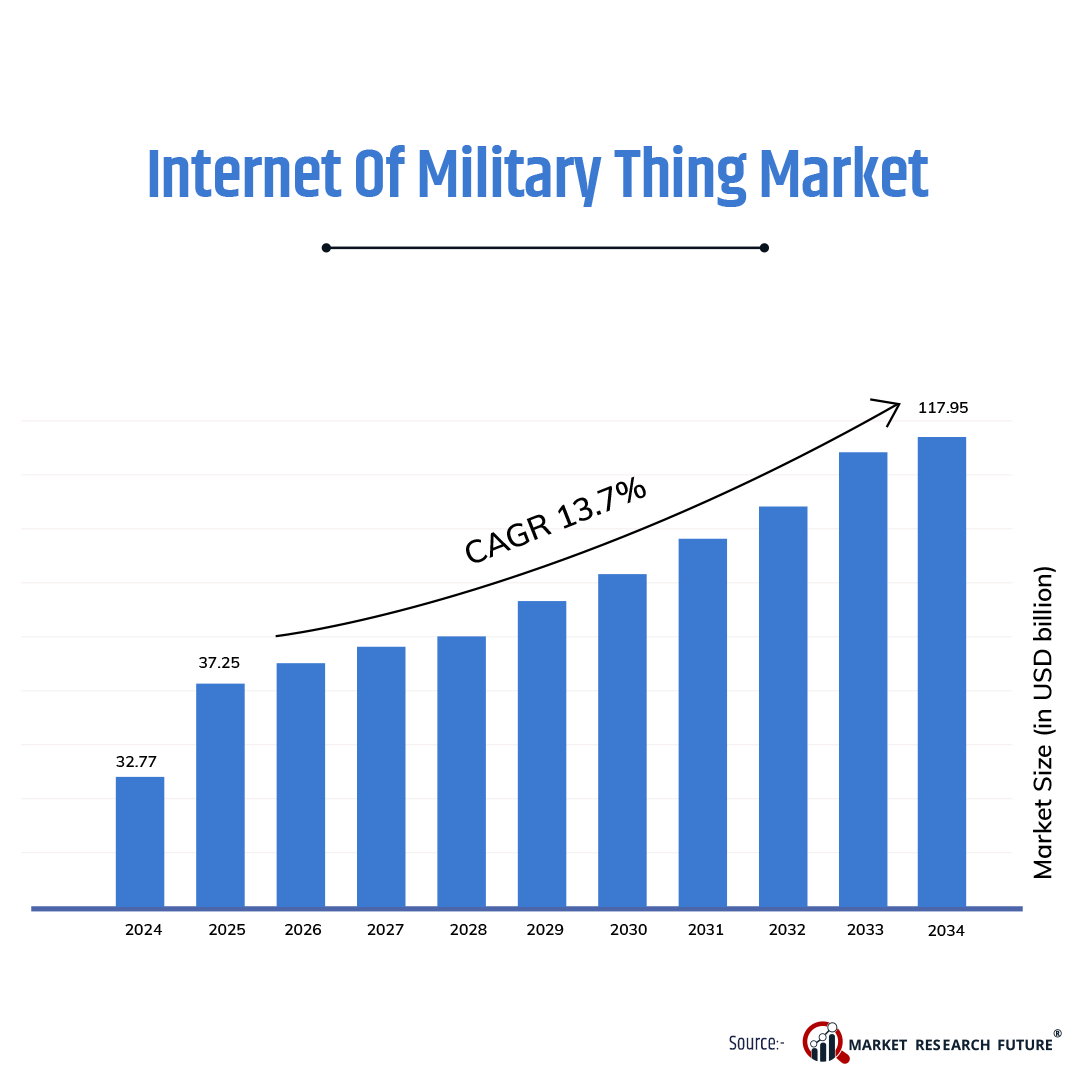

The integration of cutting-edge technologies including artificial intelligence (AI), cloud computing, and 5G is propelling the Internet of Military Things (IoMT) market’s rapid expansion.

This convergence has improved situational awareness, operational effectiveness, and military safety by enabling smooth connectivity, data analytics, and real-time decision-making.

In 2024, the Internet of Military Things market was projected to be worth 32.77 billion USD, according to Market Research Future. By 2034, the Internet of Military Things market is projected to have grown from 37.25 billion USD in 2025 to 117.95 billion USD. Over the projected period (2025-2034), the Internet of Military Things Market is anticipated to develop at a CAGR of approximately 13.7%.

Robotics & Autonomous Systems

The defense industry can benefit greatly from robotics and autonomous systems since they can advance military conflicts by improving situational awareness and lessening the mental and physical strain on soldiers.

Utilized on land and at sea, they allow soldiers more flexibility of movement while also lowering the risks they confront.

These autonomous platforms in defense, which range from unmanned aerial vehicles to unmanned ground systems, reduce life-threatening threats and improve throughput.

The market size for military robotics and autonomous systems was projected by Market Research Future to be 36.12 billion USD in 2022. By 2032, the market for military robotics and autonomous systems is projected to have grown from 38.86 billion USD in 2023 to 75.1 billion USD.

The military robotics and autonomous systems market is anticipated to develop at a compound annual growth rate (CAGR) of approximately 7.59% between 2024 and 2032.

Modern warfare relies heavily on robotics as countries look to advance their defense capabilities through the use of cutting-edge technologies. Drones and ground robots are examples of unmanned technologies that are becoming increasingly important as the military seeks strategic advantages.

Immersive Technologies

Military training is being revolutionized by technologies like mixed reality and virtual reality.

The primary benefit of utilizing immersive technology, like as augmented and virtual reality, is that the military may use them for training on weaponry, flying, and equipment.

To prepare soldiers for harsh conditions without the risk of casualties, these instruments aid in the organization of realistic combat conditions.

This cutting-edge technology reduces training time and enhances decision-making abilities in the defense industry.

When it comes to teaching soldiers, virtual reality and augmented reality offer improved spatial awareness, safer training venues, varied and customizable terrain, and easier access to mission rehearsals.

Because AR mimics the risks a pilot must contend with, it can also be used to train combat pilots. Soldiers are made via immersive technologies.

Achieving Cyber Security

In today’s military systems, cybersecurity is concerned with both the longevity of the networks that support operations as well as the data that is being generated or acquired.

Since cyberwarfare is real and ongoing, it should continue to be one of the most important aspects of emerging defense technology.

Because defense firms collect and exchange vast volumes of data, cybersecurity is becoming increasingly important as they use cutting-edge technologies.

Therefore, it is anticipated that the military industry will employ digital technologies and sophisticated detection systems to safeguard confidential information, spot possible cyber threats, and stop them before they do any harm.

Quantum Computing

Quantum computing has the potential to fundamentally alter the domains of simulation, logistics, and cryptography. Quantum systems are highly capable of solving a wide range of complicated problems in a short amount of time.

As quantum capabilities become a reality and more advanced solutions are needed to counter threats, the significance of cybersecurity in today’s military systems is further highlighted.

Quantum computing, one of the key factors behind new defense technologies, offers a genuinely exceptional chance for advancement and danger management.

Augmented Reality

The use of augmented reality, or augmented reality technology, in military applications, is widespread and growing quickly.

This cutting-edge military defensive technology provides soldiers with accurate maps, extensive situational awareness, and training simulations.

Blockchain

Technology is slowly spreading over the defense sector, where blockchain technology is king for safe data protection and efficient communication.

The most cutting-edge technology now transforming the defense sector is distinguished by supply chain management, mission-critical communications, and extremely secure logistics that are impenetrable.

Conclusion

The aerospace and defense industry is heading into an exciting transformation in 2025, motivated by incredible progress in technology, as well as a strong force for innovation.

From artificial intelligence and 3D printing to immersive technologies, the tools forming the future of the industry aren’t just ones that will optimize efficiency but tackle real-world issues.

Decarbonization will be paramount, and organizations will adopt new technologies that help cut their environmental footprint while enhancing their performance.

Superior defense equipment, smarter satellites, and robotics are all going to change how we think of security and connectivity and make things work better.

Even blockchain steps into the frame with greater transparency and trust within supply chains.

As we move forward, 2025 promises to be a year where innovation meets responsibility, driving the aerospace and defense industry toward a smarter, safer, and greener tomorrow.